Time for Consolidation in the Productivity Software Segment

One of the things that excites me about tracking special situations activity across events like mergers & acquisitions, management changes, insider buying and more, is the patterns or themes that start to emerge within an industry or sector. They help you build a mosaic in your mind of how that industry is evolving.

Three events that jumped out to me this week all relate to a certain type of company – one that helps its users with productivity through project management software, support ticket management, or specific workflows like creating and managing an event.

Bending Spoons’ Acquisition Spree

Italy-based technology holding company Bending Spoons announced this week that it was acquiring the event-management company Eventbrite (EB) for $500 million in cash. This is the same company that announced the acquisition of Vimeo for $1.38 billion in September 2025, Brightcove for $233 million in November 2024, and Evernote in January 2023.

Each of these companies was expected to be the next big thing (Vimeo the next YouTube for example) but couldn’t quite get there or was disrupted by competitors.

The Eventbrite acquisition comes just a little over a month after Bending Spoons decided to acquire AOL from Yahoo. Other products the company owns include Meetup, Remini, StreamYard and WeTransfer.

Rare Insider Buying at Atlassian

Going beyond M&A, a second event that jumped out when I was reviewing which company insiders were buying stock on the open market last night, was insider buying at Atlassian (TEAM). Most people who work in the tech industry are familiar with Atlassian’s products like Jira and Confluence.

The insider purchase I saw was filed after-hours yesterday by Scott Belsky, a director of the company. This Atlassian purchase was his fourth purchase this year and he is the only insider at Atlassian who has purchased shares on the open market since the company went public nearly a decade ago.

What could have prompted Mr. Belsky to buy shares of Atlassian? New directors and new CEOs often buy shares and in some instances are required to do so based on their contracts with the company. In this case, he has been on the board since August 2024 and he is buying shares under a structured plan, known as a 10b5-1 plan, that was established in May 2025.

The other reason could be that Atlassian’s stock is down more than 42% over the last year and the company is trading below 6 times forward sales despite revenue growth of over 20% last quarter.

Management Changes at Asana and Freshworks

I had invested in and done well with Atlassian years ago, but have not tracked the stock quite as closely in recent years. I was surprised to see just how much the stock was down this year and so I decided to check how some of the other productivity software companies like Monday.com (MNDY), Asana (ASAN), HubSpot (HUBS) and Freshworks (FRSH) were doing.

Both Monday.com and HubSpot lost nearly half their value over the last year. Asana appears to have done better with the stock down just 6% over the last year but when you pull back the curtain to a five year chart, it also lost nearly half its value.

The little C icons you see on the chart above are management changes at Asana. This brings us to the third set of events from this week that got me thinking about the need for consolidation in the productivity software segment.

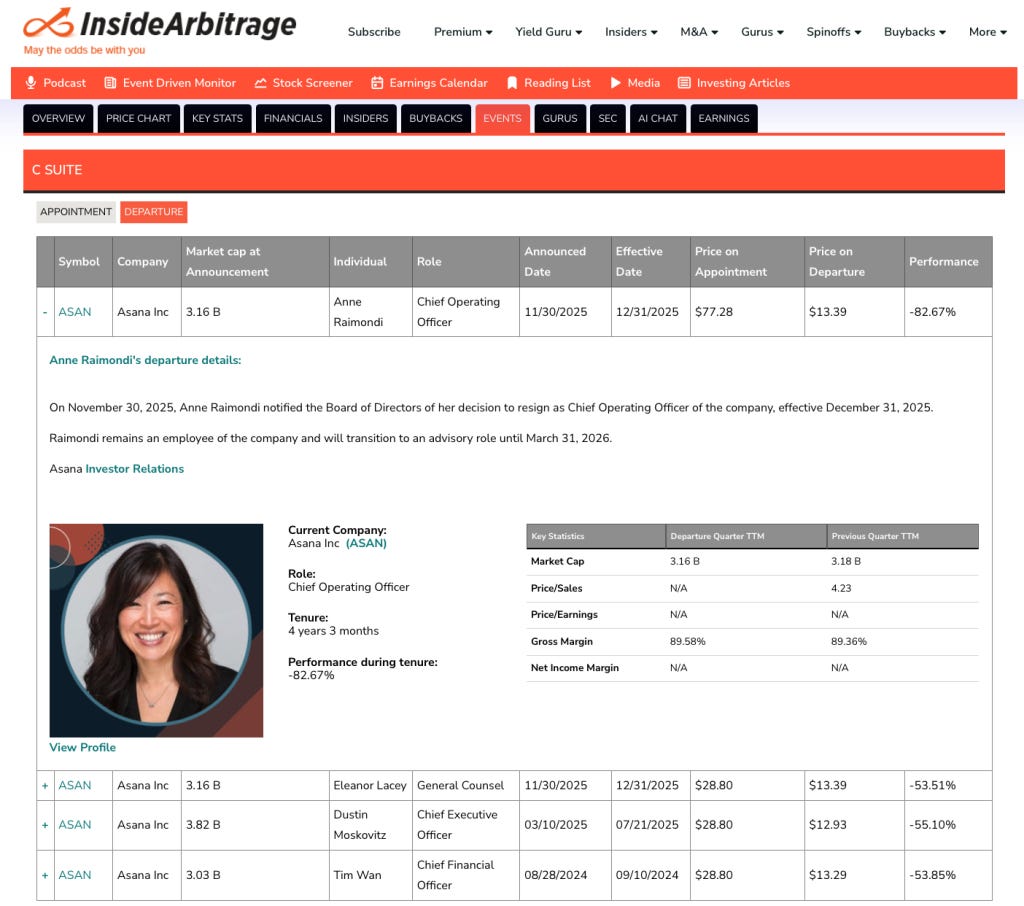

The management changes at Asana started with the appointment of new CFO Sonalee Parekh, which we covered in an article titled Asana: All Pain, No Gains in September 2024. This was followed by a string of additional C-Suite departures, including founder and CEO Dustin Moskovitz stepping down in July 2025 and two additional departures this week by their General Counsel Eleanor Lacey as well as their COO Anne Raimondi.

Freshworks (FRSH) has followed a similar trajectory with its stock down 65% from the IPO price of $36 in September 2021 and the Founder/CEO Girish Mathrubootham stepping down last year.

Asana’s new CEO Dan Rogers and Freshworks’ new CEO Dennis Woodside appear to be amazing operators but what they are faced with is a highly competitive marketplace and a significant shift in investor sentiment towards software companies. These former darlings, once afforded nosebleed valuations are now being perceived as companies that could be easily disrupted by a slew of new AI-native startups.

While enterprise software companies like Oracle (ORCL), Workday (WDAY), and SAP are unlikely to be disrupted anytime soon, productivity software companies that are not focusing deeply on workflows of specific verticals are certainly at risk.

In this environment, it might be a good idea for the productivity software companies to consider mergers instead of waiting for either the private equity firm Thoma Bravo to come knocking or for Bending Spoons to show up long after the dust has settled.

Asana and Freshworks with market caps between $3 billion and $4 billion appear to be the logical acquisition candidates, although there were rumors last year that Google might be interested in acquiring Hubspot. Given Adobe’s recent decision to acquire Semrush for $1.9 billion, they could be another potential suitor for these productivity companies.

It helps that Scott Belsky, the insider that was buying Atlassian’s stock on the open market, also previously worked as Chief Strategy Officer for Adobe (ADBE).

Disclaimer: I hold a long position in Workday (WDAY). Please do your own due diligence before buying or selling any securities mentioned in this article. We do not warrant the completeness or accuracy of the content or data provided in this article.

The connection between Scott Belsky's insider buys at Atlassian and his Adobe background is interesting. You're basically calling him a sleeper agent for potential consolidation moves. If Bending Spoons keeps burning cash on these fading productivity brands, they'll need real product vision or they're just building a graveyard. Asana losing its entire C-suite while the stock bleeds out screams distressed sale, not turnaround. The AI-native threat you mentioned is real but overblown for now since most startups can't crack enterprise distribution.

Really enjoyed this format Asif !