The Special Situation Report #25: 7/10 Roundup

Summary of the Week in Special Situations

I hope you enjoy this week’s roundup, delivered to update you on the latest in public company M&A, shareholder activism, and other public situations.

Table of Contents:

Update on Developing M&A

Update on Shareholder Activism

Update on Other Special Situations

Announced M&A

Update on Developing M&A

Strategic Alternatives & Ongoing Situations

Hollysys (HOLI) buyer consortium reaffirmed $25/share takeover proposal (Press Release)

Seritage Growth Properties (SRG) shareholder Eddie Lampert agreed to vote for a plan to sell off its assets (Filing)

Spirit (SAVE) postponed Frontier (ULCC) deal vote to continue talks with Frontier and JetBlue (JBLU) (Filing)

Twitter (TWTR) buyer Elon Musk notified the Company he is terminating their merger agreement (Filing)

Rumors

Avalara (AVLR) reportedly targeted by PE firm Vista Equity (Seeking Alpha)

Cano Health (CANO) gained on speculation Humana (HUM) may be interested in a takeover (Seeking Alpha via Dealreporter)

Magnachip (MX) gained on a report that LX Group had completed its due diligence (The Bell - in Korean, requires translation)

MGM Resorts (MGM) may seek to revisit Entain (GMVHY) takeover bid, says analyst (Casino.org)

OneMedical (ONEM) is weighing options after attracting takeover interest from CVS (CVS) (Bloomberg)

Premier Inc. (PINC) engaged banks earlier this year to explore strategic alternatives (Axios Pro)

Seagen (SGEN) reportedly in advanced talks with Merck (MRK) for a $40bn+ sale (WSJ)

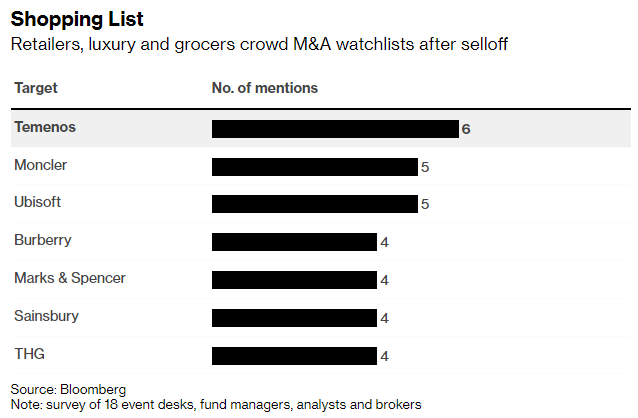

And here are some commonly speculated European takeover targets, per Bloomberg:

LINK to the full article.

Update on Shareholder Activism

Alkermes (ALKS) shareholder Sarissa Capital expressed concern with CEO, threatened to remove and replace directors (Filing)

Lazydays (LAZY) 13% shareholder B. Riley continues to add to its position (Filing)

Republic First Bancorp (FRBK) appeals court overturned the appointment of a custodian, freeing the company to fill its empty board seat (Filing)

Sound Financial (SFBC) 13D filer Joseph Stillwell disclosed additional purchases (Filing)

Swedish Match (SWMAY) gained on reports activist Elliott is building a stake and plans to oppose its sale to Philip Morris (PM) (Reuters)

Update on Other Special Situations

Spin-Offs

GSK (GSK) shareholders approved the spin-off of Haleon, paving the way for trading to begin on July 18th (Filing, Financial Times)

Other

Rubicon Technology (RBCN) accepted a tender offer to purchase 45% of outstanding shares at $20 per share; RBCN will issue an $11 dividend to remaining shareholders and delist (Filing)

Announced M&A

Target / Acquirer – Transaction Enterprise Value

Energy & Natural Resources

Alexco Resource (AXU) / Hecla Mining (HL) – $81mm (Press Release, Presentation)

Healthcare

Meridian Bioscience (VIVO) / SD Biosensor & SJL Partners – $1.5bn (Press Release)

Tyme Technologies (TYME) / Syros Pharmaceuticals (SYRS) – $59mm (Press Release, Presentation)

Industrials

Resolute Forest Products (RFP) / The Paper Excellence Group – $2.9bn (Press Release)

If you enjoyed reading this Report, please do me the huge favor of simply pressing the “Like” button.

Just reply to this email to get in touch, or follow me on Twitter.