I’m planning to publish my latest report this Thursday. Stay tuned for that. In the meantime, I have all the latest news below.

Table of Contents:

Update on Developing M&A

Update on Shareholder Activism

Update on Other Special Situations

Announced M&A

Update on Developing M&A

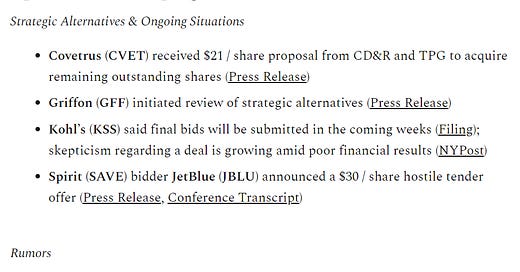

Strategic Alternatives & Ongoing Situations

Covetrus (CVET) received $21 / share proposal from CD&R and TPG to acquire remaining outstanding shares (Press Release)

Griffon (GFF) initiated review of strategic alternatives (Press Release)

Kohl’s (KSS) said final bids will be submitted in the coming weeks (Filing); skepticism regarding a deal is growing amid poor financial results (NYPost)

Spirit (SAVE) bidder JetBlue (JBLU) announced a $30 / share hostile tender offer (Press Release, Conference Transcript)

Rumors

American Axle (AXL) reportedly exploring a sale (Seeking Alpha)

Braskem (BAK) reportedly subject of takeover interest from Ultrapar (UGP) (Seeking Alpha)

Chegg (CHGG) and 2U (TWOU) reportedly subject of takeover interest from Indian startup Byju (Bloomberg)

Electronic Arts (EA) rumored to have had takeover discussions with Amazon (AMZN), Disney (DIS), Apple (AAPL); held discussions with Comcast (CMCSA) regarding merger with NBC Universal (Forbes)

Magnachip (MX) potential buyer LX Group reportedly partnered with Carlyle (CG) in bid (Maeil Business News Korea)

Q2 Holdings (QTWO) reportedly exploring sale after receiving inbound interest (Bloomberg)

WideOpenWest (WOW) reportedly draws interest from Morgan Stanley’s (MS) infrastructure investment arm (Bloomberg)

Update on Shareholder Activism

Aerojet Rocketdyne (AJRD) chairman plans to install former COO Tucker as CEO if he wins proxy battle (Filing)

American Vanguard Corporation (AVD) ISS and Glass Lewis support Cruiser Capital nominees (Filing)

Athira Pharma (ATHA) investor Ric Kayne suspended his proxy campaign (Filing)

Credit Suisse (CS) shareholder Artisan Partners called for new CEO (Reuters)

Hasbro (HAS) filed an investor presentation in connection with annual general meeting (Filing)

Hemisphere Media Group (HMTV) shareholder Edenbrook Capital sent letter to the board expressing displeasure with sale price (Press Release)

MiMedx Group (MDXG) released a presentation highlighting value creation (Filing)

Quotient Technology (QUOT) announced cooperation agreement with Engaged Capital (Press Release)

Republic First Bancorp (FRBK) chairman Hill removed from role, filed lawsuit against company (Filing)

ReWalk Robotics (RWLK) confirmed receipt of director nominations from Creative Value Capital (Filing)

SpartanNash (SPTN) activists Macellum and Ancora issued supplemental presentation (Filing)

Turtle Beach (HEAR) entered into cooperation agreement with Donerail Group (Press Release)

Update on Other Special Situations

Spin-Offs

Renault (EPA: RNO) said it was studying a spin-off of its EV unit (Reuters)

Other

National Cinemedia (NCMI) gained as AMC (AMC) disclosed 7% stake (Filing)

Nintendo (NTDOY) received a 5% investment from the Saudi Arabia sovereign wealth fund (TechSpot)

XPO Logistics (XPO) reportedly considering sale of its freight-forwarding unit (FreightWaves)

Announced M&A

Target / Acquirer – Transaction Enterprise Value

Energy & Natural Resources

Colgate Energy Partners / Centennial Resource Development (CDEV) – $3.9bn (Press Release, Presentation)

Rattler Midstream LP (RTLR) / Diamondback Energy (FANG) – $575mm (Press Release)

Industrials

ManTech (MANT) / Carlyle – $4.2bn (Press Release)

If you enjoyed reading this Report, please do me the huge favor of simply pressing the “Like” button.

Just reply to this email to get in touch, or follow me on Twitter.