The Special Situation Report #130: 10/6 Roundup

Summary of the Week in Special Situations

Table of Contents:

Update on Developing M&A

Update on Shareholder Activism

Update on Other Special Situations

Announced M&A

Powered by InsideArbitrage.

Update on Developing M&A

Grifols (GRFS): Canadian fund Brookfield (BN) reaffirmed its interest in a potential takeover of the Spanish drugmaker and requested more time to complete due diligence for its possible bid. (Reuters)

23andMe (ME): CEO Anne Wojcicki would no longer be open to considering third-party takeover proposals for the company. (13D filing)

Barnes Group (B): Apollo Global Management (APO) is in talks to acquire Barnes in a deal likely to value it at more than $45 per share. (Reuters)

Vestis (VSTS), UniFirst (UNF): Elis held conversations with Vestis and UniFirst, and both discussions have been terminated. (Press Release)

Vista Outdoor (VSTO): Agreed to sell itself in parts to two separate buyers for a total of $3.35 billion, including debt. (Reuters)

Rumors

TTEC Holdings (TTEC): CEO Kenneth Tuchman delivered a non-binding proposal to the Board to acquire all of the outstanding shares of common stock for a cash consideration of $6.85 per share. (13D filing)

Emcore (EMKR): Mobix Labs (MOBX) announced it has submitted a non-binding proposal to acquire all of the outstanding shares for $3.80 per share in cash. (Press Release)

Reservoir Media (RSVR): Hedge fund Irenic Capital Management urged the company to undertake a full strategic review of all alternatives to maximize shareholder value and to form a special committee of the Board to oversee such a review process. (13D Filing)

Hall of Fame Resort & Entertainment (HOFV): IRG Canton Village Member, which owns about 12.52% of shares, submitted a preliminary non-binding proposal to the Board to acquire all the remaining shares for cash consideration of $1.98 per share. (13D Filing)

Helix Energy Solutions (HLX): Exploring strategic options, including a potential sale. It is working with advisers to gauge interest from potential buyers. (Bloomberg)

UniFirst (UNF): Elis SA made an informal takeover proposal to UniFirst after it reached out to Elis to gauge its appetite for a deal following Elis’s takeover approach to rival Vestis (VSTS) became public last month. (Bloomberg)

Arcadium Lithium (ALTM): Rio Tinto (RIO) has been holding talks to buy lithium miner Arcadium. It could be valued between $4 billion and $6 billion or higher. (Reuters)

Update on Shareholder Activism

CVS Health (CVS): Investor Glenview Capital has denied reports that it is pushing for a breakup of the company, asserting that it has been engaged in “good faith and constructive conversations” with management about improving the company. (Press Release)

AGCO Corporation (AGCO): Tractors and Farm Equipment urges the company to consider a board refresh to add new independent directors, form a Strategic Transformation Committee, and separate the roles of Chairman and CEO. (13D Filing)

Air Products and Chemicals (APD): Activist investor Mantle Ridge has built over $1 billion stake in Air Products and plans to push for improvements at the industrial gas manufacturer. (WSJ)

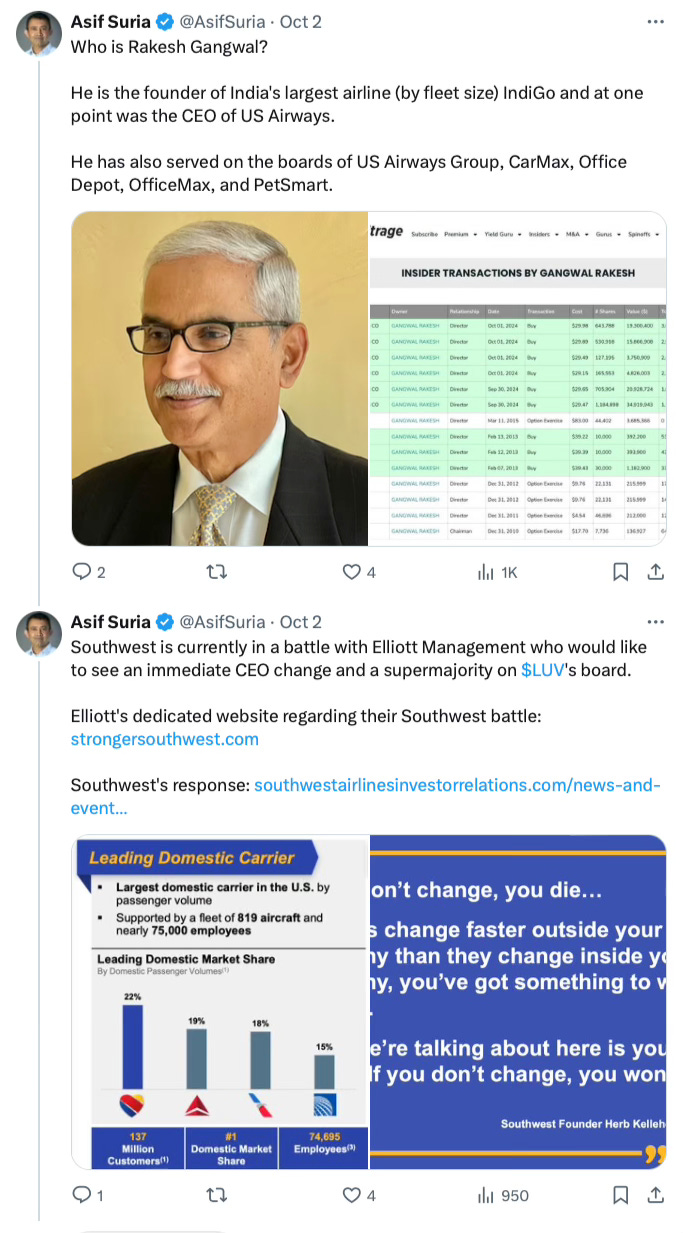

We normally don’t report on insider transactions in this report, but in the context of Elliott’s campaign to oust the CEO of Southwest Airlines (LUV) and replace a majority of the board, it is worth noting a couple of large purchases by the Chairman and a new director of the company.

I tweeted the following last week:

Update on Other Special Situations

TC Energy (TRP): TC Energy completed the spinoff of its Liquids Pipelines business into South Bow Corporation. South Bow shares began trading on the TSX under the ticker SOBO on October 2, 2024, and will start trading on the NYSE on October 8, 2024. (Press Release)

SITE Centers (SITC): SITE Centers completed the spin-off of Curbline Properties. Curbline (CURB) owns convenience shopping centers in high-income suburban areas and plans to operate as a REIT. SITE Centers shareholders received two shares of Curbline for each share held as of September 23, 2024. (Press Release)

MDU Resources (MDU): MDU Resources' board has approved the spinoff of its construction services subsidiary, Everus Construction Group, through a pro rata distribution of Everus common stock. MDU stockholders will receive one share of Everus for every four MDU shares owned, with the distribution set for October 31, 2024, to stockholders of record as of October 21, 2024. (Press Release)

Announced M&A

Target / Acquirer – Approximate Transaction Enterprise Value, Expected Closing

Energy

Martin Midstream Partners (MMLP) / Martin Resource Management Corporation - $729.08 mm, End of 2024 (Press Release, Merger Agreement)

Materials

SilverCrest Metals (SILV) / Coeur Mining (CDE) - $1.7 bn, Q1 2025 (Press Release)

If you enjoyed reading this Report, please do me the huge favor of pressing the “Like” button or sharing it with other investors interested in special situations.

The content herein is informational and should not be relied upon as fact. We do not warrant the completeness or accuracy of the content or data provided in this article. Do your own diligence before making any investment decisions.