Meta's CMO Alex Schultz Buys Shares of Lindblad Expeditions

Insider Weekends

Lindblad Expeditions Holdings Inc (LIND): $8.89

Market Cap: $485.27M

Enterprise Value: $1.04B

It was odd to see that both insider buying and insider selling dropped sharply this week, especially considering that companies are starting to exit the quiet period as Q1 2025 earnings results slowly trickle in. Nevertheless, the lower levels of insider activity do allow us to dive a little deeper into companies that we see while tracking insider purchases every single day in our Event Driven Monitor. One such company that caught our eye was Lindblad Expeditions (LIND), a company that offers expedition cruising and land-based adventure travel experiences like no other.

We actually wrote about Lindblad back in 2021, when we saw a insider purchase in the company, and we stated the following in that article:

CEO Dolf A. Berle acquired 36,500 shares of this expedition cruising and adventure travel company, paying $17.45 per share for a total amount of $636,974. Mr. Berle increased his stake by 166.27% to 58,452 shares with this purchase.

When I first looked at this insider purchase earlier this week, I came away unimpressed and didn’t quite understand why Mr. Berle was buying shares. When I looked at this profile, I noticed that he took on the role of CEO at Lindblad last month. He previously served as the CEO of Topgolf Entertainment and as the President and COO of Dave & Buster’s (PLAY) before that. The common thread of this career has been entertainment companies whether it was as the President of bowling company Lucky Strike Lanes or as the COO of House of Blues Entertainment. Callaway Golf completed its acquisition of Topgolf in March 2021 and Mr. Berle is off to another adventure at a company that is focused on entertainment and experiences. He received his bachelor’s degree from Harvard University in 1985 and his M.B.A. from Harvard Business School in 1991.

Lindblad Expeditions Holdings is a company that provides unique adventures across the globe often in partnership with National Geographic. Trips range from a guided trip through the Amazon rainforest aboard skiffs or the Galapagos on the National Geographic Endeavour II. A new CEO at the helm is exactly what this company needs after the COVID-19 pandemic brought this unique company to a standstill during much of last year. Even before the pandemic, while revenue grew in 11% to $343.1 million in 2019, very little of that made its way to the bottom line. The tailwinds of a post-pandemic reopening, consumer emphasis on experiences over consumption and an experienced CEO could bode well for the company in the years to come.

Revolving CEO Door

Things haven’t quite played out well for Lindblad since that article. The CEO at the time was replaced by the company’s founder, Sven-Olof Lindblad, in June 2023. Mr. Lindblad then transitioned to the role of Chairman of Lindblad’s Board of Directors at the start of this year, with Natalya Leahy joining the company as CEO. Ms. Leahy comes over from Seabourn Cruise Line, where she served as President. In the midst of the CEO transitions, Lindblad also replaced its CFO. The company’s stock now trades at $8.89 – nearly half of what Mr. Berle paid when he bought shares in 2021.

National Geographic and Disney Partnerships

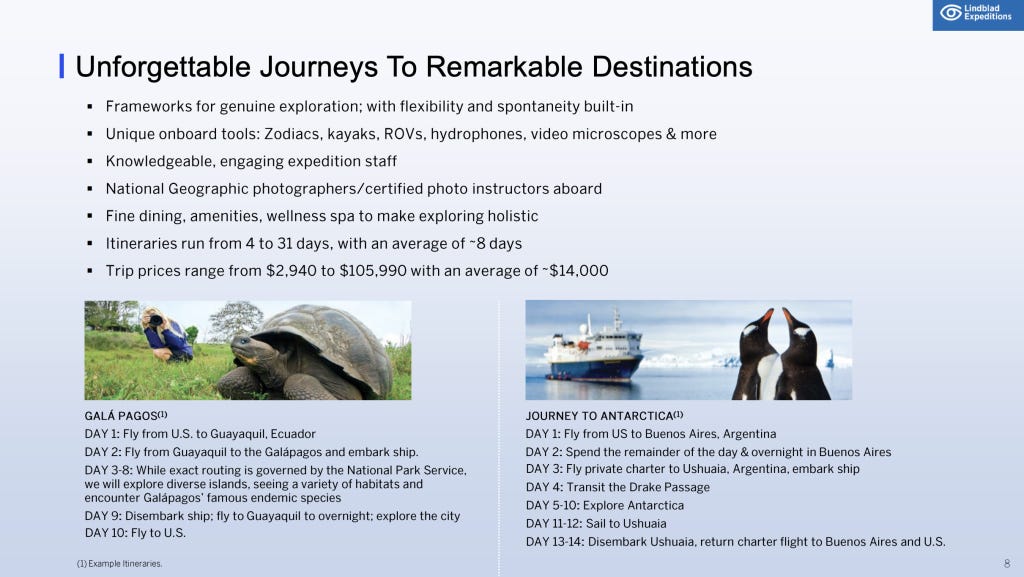

So what exactly happened to Lindblad, and does the company have potential in the future? As we mentioned earlier, Lindblad (based in New York) is an expedition travel company that journeys to some incredibly unique locations, including Antarctica or the Galapagos Islands. The company pioneered civilian polar tourism by bringing the first group of non-scientists to Antarctica in 1966. Many of Lindblad’s trips are guided by National Geographic experts – and in November 2023, the company announced a 17 year extension and expansion of their partnership with National Geographic, a business relationship that first began in 2004. This new expansion also allows for new sales and marketing with Disney (especially Disney’s cruise lines), as well as an exclusive relationship with Disney for expedition ships with less than 295 passengers in the US and Canada. The partnership also allows Lindblad to expand its National Geographic-branded fleet worldwide, rather than focusing primarily on U.S. and European markets.

Given how intensive, unique, and expensive these expeditions are, Lindblad is evidently targeting a very niche audience. The company describes its target population, or “core guest” as an active retiree who has a passion for adventure and learning. Approximately 95% of their guests are U.S.-based, with an average age of 59 years old and a median net worth exceeding $2 million. Essentially, Lindblad is expliclty targeting an affluent older population – and to some extent, the strategy seems to be working. Customer loyalty is quite strong, with 37% of travelers returning as guests and about 40% of bookings being generated directly through word of mouth referrals or direct sales channels.

Keep reading with a 7-day free trial

Subscribe to The Special Situation Report to keep reading this post and get 7 days of free access to the full post archives.