Insider Buying in an Active M&A Situation

Insider Weekends

Quanterix Corp (QTRX): $6.06

Market Cap: $235.31M

Enterprise Value: $4.84M

Key Insights

An unusual insider purchase of Bauch Health (the old Valeant Pharmaceuticals) by the hedge fund legend John Paulson

Quanterix insiders, including the CEO and co-founder David Walt, made significant purchases despite ongoing controversy over the Akoya acquisition and activist opposition to the deal

Quanterix currently trades below net cash on the balance sheet

Both Quanterix and Akoya are unprofitable with declining revenues, raising doubts about the merger’s ability to create shareholder value or achieve profitability

The acquisition is expected to expand the addressable market and deliver cost synergies, but the path to profitability remains unclear and guidance was lowered

Given persistent losses and market volatility, I am refraining from investing in Quanterix for now, but will monitor for signs of organic growth or positive cash flow

John Paulson’s Bet on Bauch Health

Before we get into our main feature for this week’s Insider Weekends article, we wanted to briefly highlight another purchase that made our list of top five insider buys and sells. John Paulson, a Director at Bausch Health Companies (BHC), bought $14.7 million worth of the company’s stock. The purchase was fascinating to us for multiple reasons. First – Bausch Health Companies was once known as the “Enron of Pharma,” back when it operated under the name Valeant Pharmaceuticals.

The company, founded in 1959, had turned into a pharmaceutical giant known for its roll-up strategy by the 2010s, where acquisitions of smaller companies became the name of the game. Bill Ackman had started a position in the business in early 2015, but by the end of the year, a short report was released by Citron Research, calling the company “toxic” and highlighting its mountain of debt.

Soon after, the company delayed releasing quarterly earnings due to accounting problems, legislators got involved due to accusations of price gouging patients, and a criminal investigation was launched by August 2016 that concluded with former Valeant executives being charged with fraud. By 2017, Ackman had sold his stake in the company after suffering a nearly $3 billion loss and the company sold its skincare brands like CeraVe to L’Oreal for over $2 billion. The company renamed itslef to Bausch Health Companies in 2018 and spun out the eye-health and contact lens company Bausch + Lomb (BLCO) in 2020. The parent is down 62.72% since the spinoff, with Bausch + Lomb also down 38.35%.

As it stands today, Bausch Health Companies still struggles with maintaining stable and consistent profits, and has a massive debt balance of $21.51 billion against a market cap of just $2.21 billion. Which is why the purhase by Director John Paulson is confusing – we’re not quite sure what he’s seeing in the company, but clearly the market is happy – the stock has risen over 18% since his first purchase last week.

The Greatest Trade Ever

The market paying attention to John Paulson isn’t all that surprising. One of the first books I read about investing was The Man Who Solved the Market by Gregory Zuckerman. Mr. Zuckerman also wrote a book called The Greatest Trade Ever – which tells the story of how the hedge fund manager John Paulson (who had a background in special situations and M&A) bet against risky mortgages in 2006 and onwards, accurately timing the implosion of the housing market and the Great Recession, making more than $15 billion for his firm.

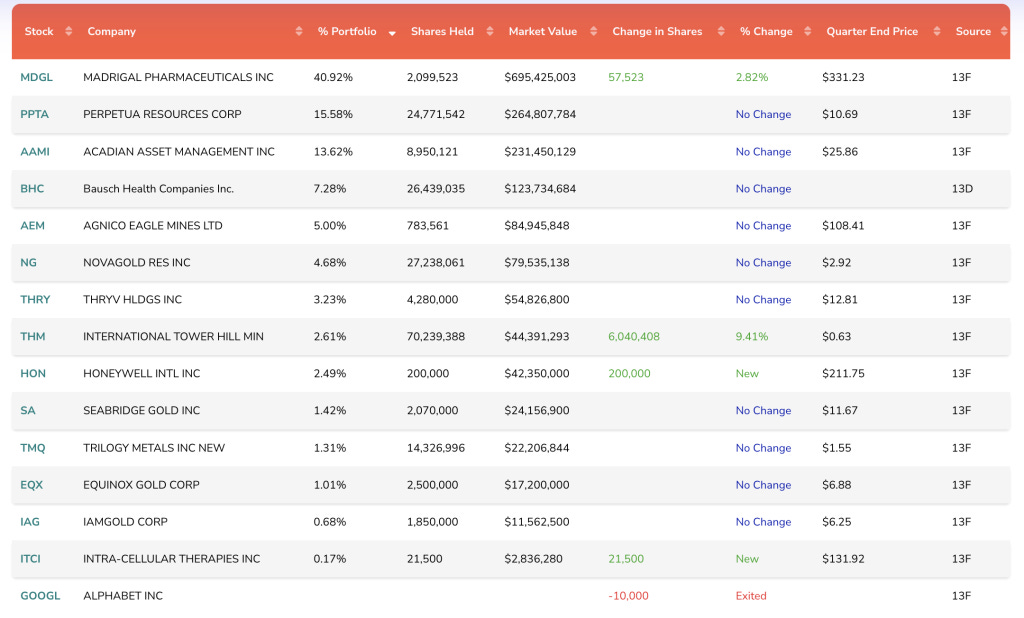

Mr. Paulson then went on to invest very heavily in gold, something he remains invested in today – looking at the snapshot of his portfolio as provided by his 13F filing. Other interesting things to note is that over 40% of his portfolio is invested in a single company, Madrigal Pharmaceuticals (MDGL) and that Bausch makes up approximately 7% of the portfolio. Naturally, a purchase from an insider with such a successful track record who has been with the Board since 2017 is a good signal, but we’re not fully seeing the thesis when it comes to a company with such a massive debt balance and slowing revenue growth.

It is also important to remember that after “The Greatest Trade Ever”, Paulson’s bet on rising inflation and his investments in gold didn’t play out the way he expected, leading to years of subpar performance. After a 26 year run, he returned external capital to investors in 2020 and converted the firm into a family office.

Insider Buying in an Active M&A Situation

Moving onto the insider purchases we actually wanted to highlight today – in last week’s article, we discussed insider buying in the middle of an acquisition in the target, which is extremely rare. What’s also somewhat unusual to see is insider buying in the middle of an acquisition in the parent company, which is why we were shocked to see three different insider purchase shares of the life sciences company Quanterix (QTRX).