Independence Day Sale - The Special Situations Report Premium!

Comprehensive suite of tools, custom alerts, screens and analysis

This Independence Day Weekend, we are launching our big annual sale to make our premium subscription services more accessible to both retail and professional investors. We have often heard that our pricing is too steep for some of our subscribers and we are attempting to address that through a special promotion.

If you use this link, the cost of any of our premium subscriptions will be discounted by 33% for new subscribers. If you sign up for our annual subscription and use the promo code, your effective subscription price for our premium service drops to just $67/month.

If you choose to renew your subscription, the discounted rate will continue. Since launching our premium service in January 2018 we expanded our service to include four additional event-driven strategies and several new tools and screens.

This comprehensive Premium service includes:

Tools:

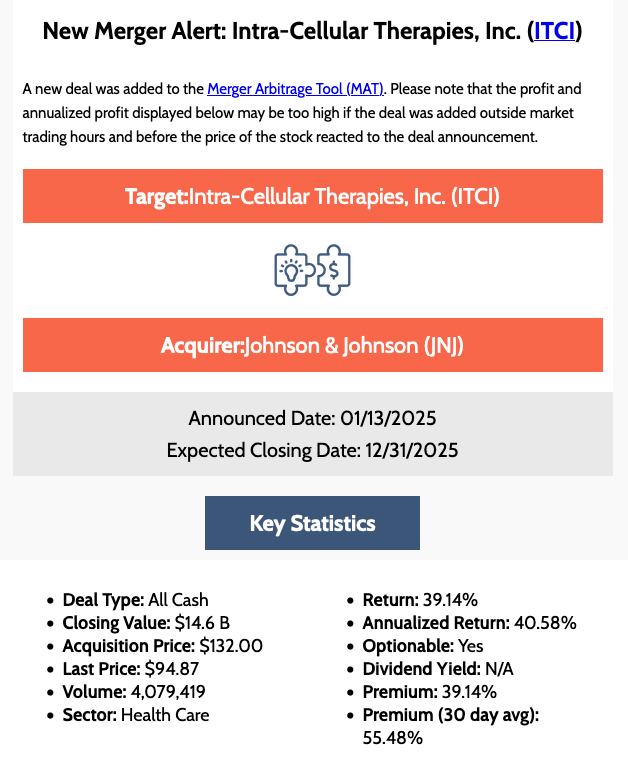

The Merger Arbitrage Tool (MAT) provides a list of all active U.S. deals including their spreads and potential annualized returns. Includes a spread history chart and the ability to create a curated list of mergers you would like to track.

Deals-in-the-Works (DITW) tool that includes a list of all pre-merger situations with updates and whether the situation resulted in a definitive merger agreement.

My Portfolio Plus allows you to create multiple portfolios and view specific event-driven information like management changes, spinoffs, buybacks and insider transactions, easily access SEC filings, and see valuation information for your portfolios. The best part is that My Portfolio Plus will notify you by email either immediately, daily or weekly when a corporate action you are interested in occurs, the company you are following files a specific SEC filing (8-K, 10-Q, 10-K, 13D, etc.) or a stock on your watchlist hits a valuation threshold defined by you.

… and a whole lot more.

Alerts:

Email alerts when we add new mergers and acquisitions to our database

Email alerts when we add new pre-merger situations to our “deals in the works” database

Event-Driven Monitor emailed to you before the market opens every weekday with updates on active M&A situations, pre-deal or rumored situations, spinoff announcements or updates, buyback activity, insider buying, activist campaigns, SPACS and C-suite transitions. In short, everything you will need to stay on top of the special situations landscape in the U.S.

Email alerts when an insider purchase meets criteria specified by you

Custom Screens:

Spinsider – A screen that identifies insider buying in spinoffs or their parent companies

Double Dipper - A screen that identifies companies with insider buying that are also buying back their stock

Flip Floppers – Company insiders that were buying who suddenly change course and start selling or vice versa

… and a whole lot more.

Analysis:

Monthly Special Situations Newsletter – Comprehensive newsletter that includes writeups on two spotlight ideas and a roundup of all special situations from the prior month.

Merger Arb Mondays – A comprehensive overview of M&A and SPAC activity from the prior week including deal updates, week-over-week spread changes, deals with the biggest spreads and more. We have been publishing this series of posts continuously for nearly 14 years.

Insider Weekends – Our roundup of the top 5 insider purchases and sales from the prior week including a writeup on a specific insider transaction.

… and a whole lot more.

The price of our regular service is $150/month. Signing up for a full year brings down the price by 33% to $1,200/year.

This Independence Day, we are providing a 33% launch discount on both our monthly and annual plans, which drops the price of the monthly plan to $100/month and the annual plan to just $804/year.

You can access this special discount from the following link to sign up now. The discount expires in 9 days.

https://www.thespecialsituationreport.com/2025July4

Shortly after you sign up (usually with 8 to 12 hours), we will set you up with full access to all the tools and other features on our sister site InsideArbitrage.