How Investor Pushback Killed the CoreWeave - Core Scientific Merger

Deal Postmortem

2025 has turned out to be blockbuster year for M&A activity, not just in terms of number and size of deals announced ($899 billion worth of new deals announced through November 30, 2025) but also the relatively low number of deals that failed. Only five deals failed this year, while 184 deals completed successfully. This compares with 12 deal failures in each of the last two years.

Not only did we see lower deal failures this year, the reasons these deals failed are also very different. More than half the deals that failed in 2024 were on account of regulatory issues, while only one deal failed this year (Cross Country Healthcare) because the FTC would not approve the deal before the termination deadline.

History does not repeat itself but it often rhymes (quote is attributed to Mark Twain) and this is one of the reasons we built a Failed Mergers & Acquisitions tool several years ago to allow us to track every failed merger over the last fifteen years.

Last year, we decided to go one step further and started writing detailed deal postmortems covering every twist and turn of large failed M&A transactions. The goal was to draw conclusions from these case studies, which would in turn inform the probabilities assigned to the closing of future transactions.

We wrote three deal postmortems last year regarding the failed acquisitions of iRobot (IRBT), Spirit Airlines and Capri (CPRI), and this is our second postmortem this year.

Key Insights:

CoreWeave’s $9 billion all-stock bid for Core Scientific triggered immediate market skepticism and a widening deal spread.

The companies had a complicated history, including a year-old rejected buyout attempt and long-term hosting agreements linking their businesses.

Core Scientific’s post-bankruptcy rebound and CoreWeave’s rapid rise set the stage for a valuation battle shareholders weren’t willing to overlook.

Activists, hedge funds, and proxy advisors aligned against the uncollared structure of the deal, arguing the offer undervalued Core Scientific.

Regulators didn’t object, but CoreWeave’s refusal to revise the terms fueled investor resistance.

Shareholders ultimately rejected the merger, forcing both companies to terminate the deal.

Introduction:

Deal terminations aren’t common, but when they happen, they leave a trail of warning signs that can help investors spot trouble early.

Since our last post-mortem on Kroger and Albertsons, four major deals have unraveled this year. One of the most dramatic failures was the merger between Core Scientific (CORZ) and CoreWeave (CRWV). A transaction that drew intense investor backlash and ultimately became the second deal of the year to collapse due to shareholder rejection. Just days earlier, TaskUs’ (TASK) takeover attempt by Blackstone (BX) and its co-founders had also fallen apart for the same reason.

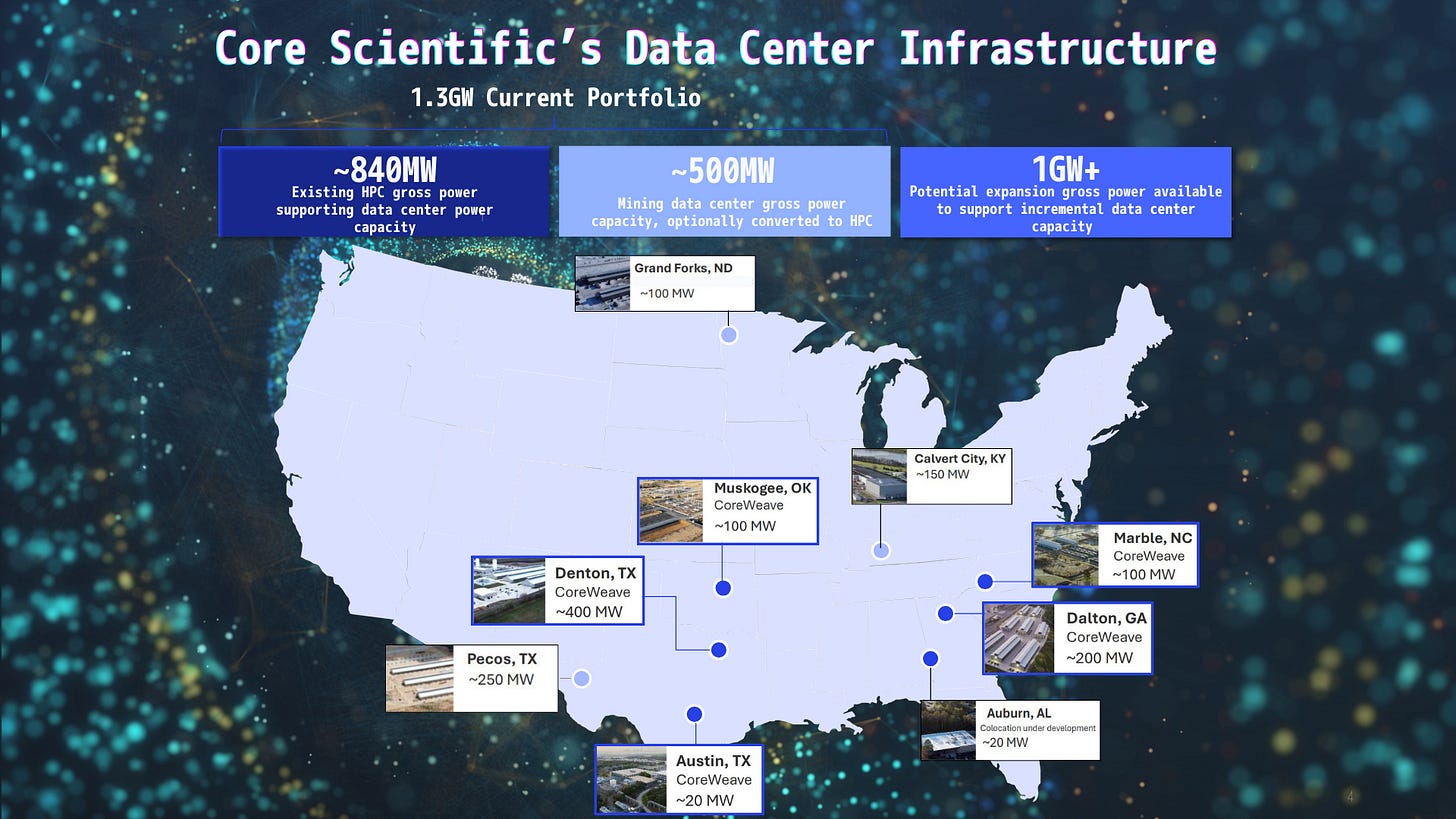

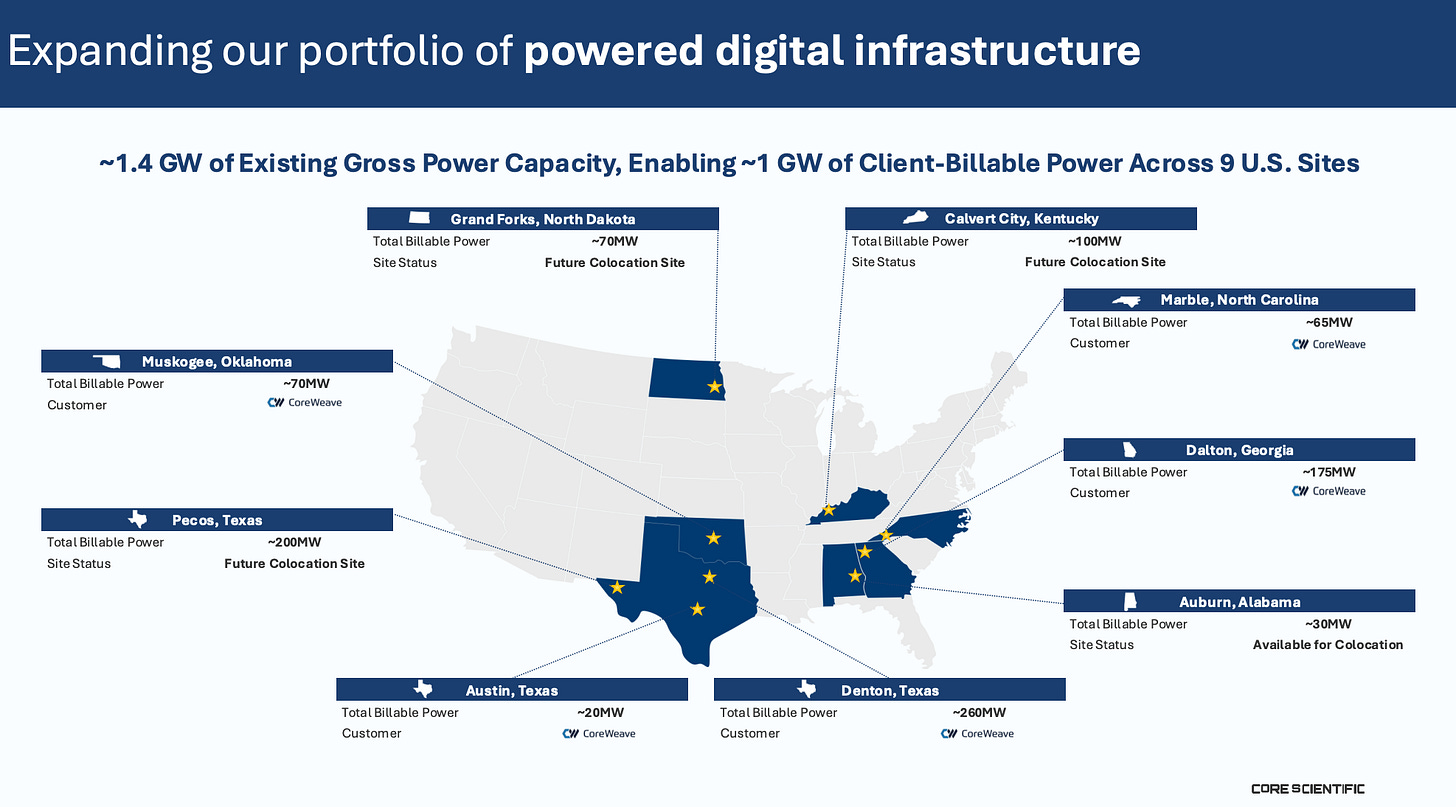

Core Scientific is one of the largest Bitcoin miners in North America, operating high-power data centers built to run energy-intensive compute at scale. CoreWeave, on the other hand, is an AI infrastructure company experiencing massive demand for GPU capacity from enterprise and generative-AI clients. The logic behind the merger was simple: repurpose and expand Core Scientific’s existing footprint to accelerate CoreWeave’s AI cloud build-out, while giving Core Scientific a path to diversify beyond volatile Bitcoin mining.

What follows is a detailed, narrative breakdown of how this deal was conceived, why it disappointed the market, and how it ultimately fell apart.

Rumors, Announcement, and Immediate Backlash

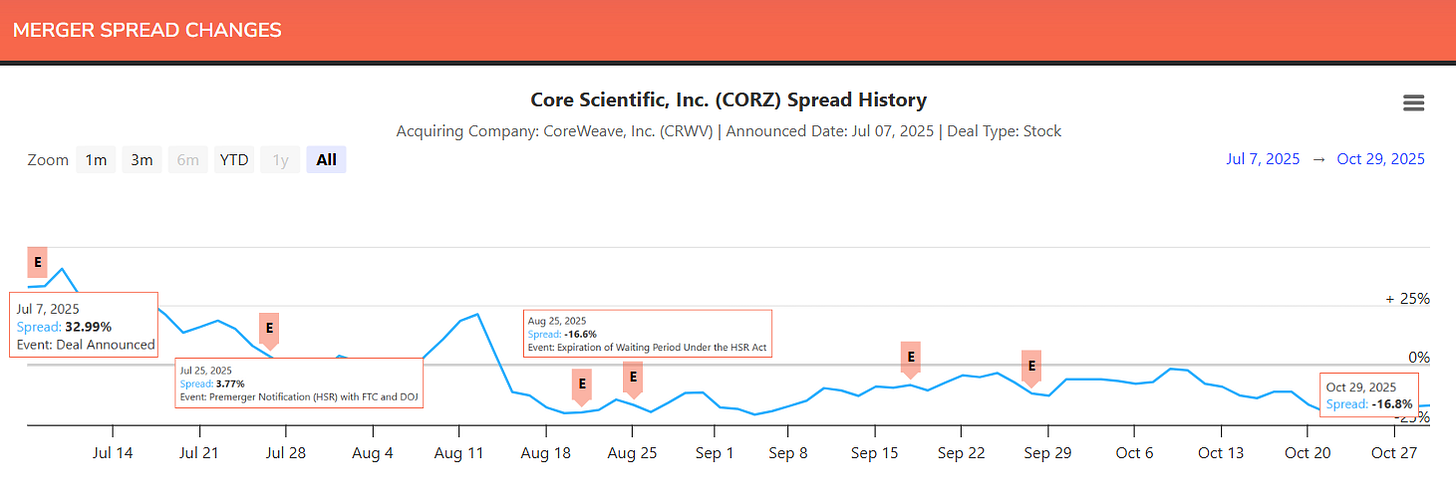

The all-stock deal for Core Scientific was announced in July 2025, valuing the company at $9 billion. Under the terms of the acquisition, Core Scientific shareholders would have received 0.1235 CoreWeave Class A shares, equivalent to $20.40 per share when announced.

But investor enthusiasm had already been stoked a month earlier when the Wall Street Journal reported that the companies were in talks. Before the report, Core Scientific traded at $12.30. The stock surged to around $18, amid speculation that a potential deal might reach as high as $30 per share.

When the actual offer came in at only a 13% premium to the last close, the market was visibly disappointed. Core Scientific’s stock dropped almost 18% to just under $15, widening the spread on the deal dramatically and signaling deep skepticism. The spread eventually surpassed 40%, as shares of both companies continued to fall in the days following the announcement.

A Second Attempt at a Merger

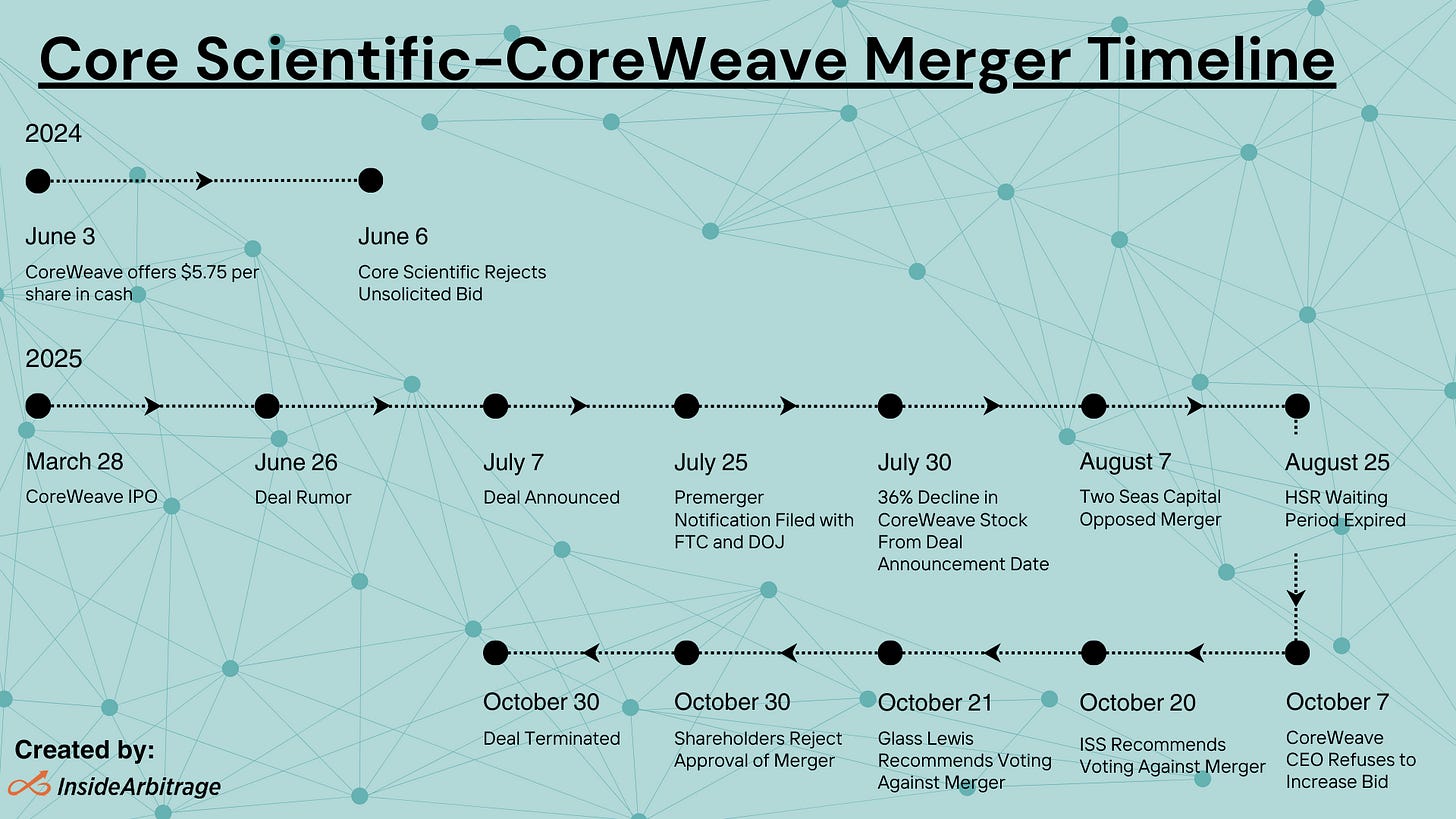

This was not CoreWeave’s first attempt to acquire Core Scientific. A year earlier, it had offered $5.75 per share in cash, an offer rejected by Core Scientific as undervaluing the business. Despite the failed attempt, the companies moved ahead with several major 12-year agreements, including an arrangement in which Core Scientific committed to supplying roughly 200 MW of infrastructure for CoreWeave’s high-performance computing services.

These agreements set the stage for renewed talks, especially after both companies’ stocks surged earlier in the year amid the broader AI and crypto infrastructure boom. But even before the merger announcement, there were concerns that both stocks were overextended, and the deal became the trigger for a sharp pullback.

Objection from Shareholders on Both Sides

The source of frustration for Core Scientific shareholders was the price. Many had hoped for something much higher, particularly given soaring valuations across the AI datacenter sector. The structure of the deal—a fixed, uncollared all-stock exchange ratio—was another major sticking point, because it exposed them to CoreWeave’s significant volatility without any downside protection.

A collared structure would have set clear upper and lower bands around CoreWeave’s share price, guaranteeing Core Scientific shareholders a baseline value regardless of market volatility. If CoreWeave traded higher, the exchange ratio would adjust down, limiting dilution for CoreWeave. If it traded lower, the ratio would step up, giving Core Scientific investors more shares to make up the difference. In other words, a collar would have neutralized the very risk shareholders were protesting, yet the deal offered no such protection.

On the CoreWeave side, investors were displeased, as well. Core Scientific’s revenue had been declining, and its impressive first-quarter results were widely viewed as unsustainable, fueled by a temporary mark-to-market accounting gain that analysts expected to reverse in the second quarter of 2025. The result was a rare situation in which both companies’ shareholders felt that they were getting less than they deserved.

Core Scientific and CoreWeave Being a Strategic Fit on Paper

Despite the market’s reaction, the strategic logic of the merger was clear.

Core Scientific operates some of the largest high-density data centers in the U.S., offering colocation services and digital asset mining. After going public via a SPAC in 2022, the company’s shares plunged during the crypto winter, eventually pushing it into bankruptcy.

When it filed for Chapter 11 in late 2022, Core Scientific had only $4 million in cash against $985 million in secured obligations, with a market cap of $78 million, a shadow of its $4.3 billion initial valuation. Much of its distress stemmed from Celsius Network’s bankruptcy.

Celsius, one of Core Scientific’s largest hosting clients, controlled 37,536 hosted miners and refused to pay higher electricity costs after filing for bankruptcy, forcing Core Scientific to absorb $29,000 per day in losses. These uncompensated expenses caused nearly $900,000 per month in additional strain.

Core Scientific emerged from bankruptcy in January 2024 after eliminating $400 million in debt, raising $55 million through a rights offering, and securing an $80 million exit facility. The company maintained its position as one of North America’s largest bitcoin miners and saw its stock rise more than 485%, buoyed by renewed enthusiasm in crypto and AI-linked digital infrastructure.

CoreWeave, which went public in April, is a cloud computing provider known for its access to cutting-edge NVIDIA GPUs. Its close relationship with NVIDIA (NVDA) (which also holds an equity stake) ensures it has early access to top-tier chips. CoreWeave counted Microsoft as its largest customer, representing 62% of annual revenue (around $1.2 billion). Its stock had surged over 200% within three months of its IPO.

From CoreWeave’s perspective, the merger was a vertical integration play. It was already Core Scientific’s largest customer, with $8.7 billion in hosting commitments over 12 years. By acquiring the company, CoreWeave could eliminate $10 billion in lease payments, gain control of 1.4 GW of contracted power capacity, and unlock an estimated $500 million in annual cost savings by 2027.

Strategically, the companies were deeply intertwined, and the merger promised significant long-term operational efficiencies. But the deal structure, not strategy, ultimately doomed the transaction.

Mounting Pressure From Investors

The massive spread on the deal was an early red flag. As CoreWeave’s stock continued to fall, the value of the fixed-exchange offer deteriorated, and shareholders demanded either a higher bid or a collar to protect their downside.

Activist investor Two Seas Capital, with 6.3% ownership and more than 19 million shares, became the most vocal opponent. It publicly argued that the deal undervalued the company and called out the lack of a collar on the deal structure. Two Seas stated openly that it would vote against the agreement unless the terms improved.

Hedge funds Helix Partners Management, JAT Capital, and Parsifal Capital Management, each holding more than 1%, also signaled opposition. Their stance was echoed by proxy advisors Institutional Shareholder Services (ISS) and Glass Lewis, which recommended that shareholders vote against the deal.

ISS questioned whether Core Scientific’s board had fully evaluated alternatives. Core Scientific’s share price since the announcement had “sent a clear signal that the market believes the company’s value is greater than the offer,” ISS said in its report. Since a post-initial public offering lockup on the company’s stock, the shares “have consistently closed at a double-digit premium to the offer,” it said.

No Regulatory Issues

The deal faced no regulatory obstacles. The HSR notifications were filed on July 25, 2025, and the 30-day waiting period expired on August 25 without any action from the Federal Trade Commission (FTC) and the Antitrust Division of the Department of Justice (DOJ). Despite the clean regulatory path, shareholder resistance only intensified.

A month after the announcement, the Financial Times reported that the shareholders were preparing to revolt unless terms improved. Some investors privately suggested that blocking the deal could force CoreWeave to raise its bid. Others stressed that a collar would bring valuation certainty, but CoreWeave showed no interest in adding one.

CoreWeave’s Refusal to Renegotiate

The final blow to the deal may have been CoreWeave CEO Michael Intrator’s unwavering stance. In an interview with Bloomberg, he made it clear that CoreWeave would not adjust its offer. “Under no circumstances will we readdress the bid,” he said. “That’s the number.” He added that if another buyer wanted to step in, they were welcome to do so, a remark widely interpreted as a sign that CoreWeave was no longer committed to salvaging the transaction.

Even after both ISS and Glass Lewis recommended voting against the deal, Intrator maintained that the valuation was appropriate and reiterated that CoreWeave would not increase its price. His comments significantly reduced the likelihood of the merger succeeding.

The Vote and the Collapse of the Merger

With no last-minute concessions and widespread dissatisfaction among major shareholders, the vote became a formality. Core Scientific announced in late October that shareholders had rejected the merger because it failed to receive the required number of votes for approval. With no path forward, the companies were left with no option but to terminate the deal.

Conclusion

Core Scientific’s stock fell from $20.74 at termination to $16.55 (last close), reflecting that investors viewed the deal as undervalued but still aren’t convinced the company can deliver comparable value on its own. Independence was the preferred outcome, but not a free pass. Rejecting the deal may have protected shareholders from a weak offer, but the price drop shows the market is now demanding execution.

CoreWeave’s slide from $131.06 at termination to $79.36 (last close) shows that without Core Scientific’s infrastructure to lean on, investors are re-pricing the real cost and complexity of scaling its GPU cloud.

Similarly, in the TaskUs Blackstone deal termination, the stock has dropped from $14.96 at termination to $12.06 at the last close, suggesting investors aren’t celebrating the company staying public. They’re uncertain about its ability to deliver on long-term growth promises without a deal in hand. The failed buyout may have preserved control, but the market is clearly demanding stronger execution and clarity on how TaskUs will navigate the post-merger fallout.

With few exceptions, we have seen this pattern multiple times in the past, where shareholder rejection of a deal has not resulted in long-term positive outcomes for investors.

Editor’s Note: Baranjot Kaur contributed to this article

Disclaimer: Please do your own due diligence before buying or selling any securities mentioned in this article. We do not warrant the completeness or accuracy of the content or data provided in this article.