Concentrated Merger Arbitrage Funds – Q3 2024 Update

This has been a challenging year for merger arbitrage with multiple widely followed deals like Capri (CPRI) failing. Beyond the hit to my personal portfolio, I also saw the impact on the professional investors I follow who focus on risk arbitrage. When I first started this series of articles, I was tracking eight funds but one of them closed shop and I am dropping one more this quarter because their portfolio is more diversified and not concentrated in their top 10 positions. A third fund saw their concentration in the top 10 positions drop to 46% but I am going to retain them for now.

I am also starting to see increased reliance on options to either hedge positions or juice returns as well as some style drift. One of them started a new position in Vestis (VSTS), the company that was spun out of Aramark, although to be fair there was a rumor in September that Vestis might get acquired.

This is our fifth update about new merger arbitrage related positions at funds that tend to have concentrated positions in their portfolio. You can find our first update here and our Q2 2024 update here.

There are currently 83 active M&A situations in the U.S. ranging from highly risky deals like the $24.6 billion acquisition of Albertsons (ACI) by Kroger (KR) that is trading at a spread (potential profit) of more than 39% to the acquisition of Poseida Therapeutics (PSTX) by Roche in a $1.5 billion deal, which is trading at a negative spread of over 4%.

Poseida Therapeutics is trading at a negative spread because of a $4 per share contingent value right (CVR) attached to the deal that we don’t assign any value to in our Merger Arbitrage Tool. Four of these 83 deals were announced this week. Every investor I talk to expects deal activity to heat up significantly in 2025 considering Trump’s win in the Presidential elections.

The concentrated funds I like to track prefer to pick and choose among those situations and tend to concentrate more than 50% of their portfolio in their top 10 positions. To reiterate what we wrote about 13F filings in our first article:

“Investment firms with over $100 million in assets are required to file form 13F with the SEC within 45 days after the end of each quarter. This filing provides a small window into the fund manager’s portfolio and is a great source for new investment ideas. You also end up with information that is potentially stale and as many investors have come to find out, you can’t just follow someone else into an idea without doing your own deep due diligence. The Gurus section of InsideArbitrage includes curated lists of professional investors and fund managers categorized based on their investment style.

We are currently tracking 49 event-driven funds of various sizes. There are firms with just 3 positions in their 13F portfolio and others with thousands of positions. This does not mean the former has their entire portfolio is just 3 positions as they may have exposure to other positions, including private companies, which don’t have to be reported on the 13F form.”

I am going to focus on some of the new additions across the six funds I am tracking. Once again the common theme appears to be that these funds are participating in pre-deal or rumored deal situations (Intel for example) and are increasingly using options to either protect downside or juice returns on the upside.

The massive $35.9 billion acquisition of Kellanova (K) by Mars for $83.50 per share in cash was a new position for all six funds. The spread at one point after announcement was 4.48%. It is currently just a little under 3% (about 5% annualized) as the companies await regulatory approvals. Expected closing in the first half of 2025.

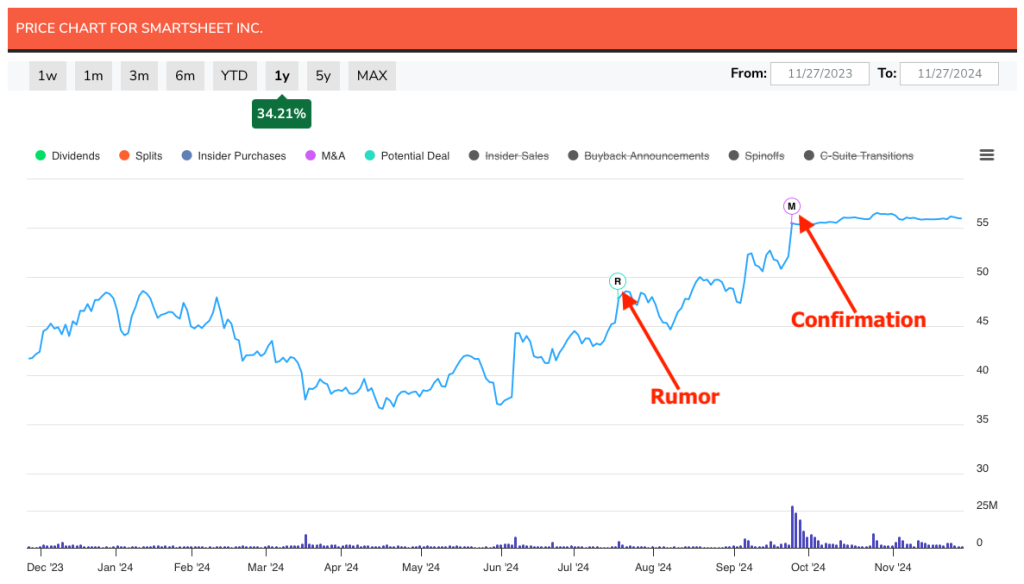

The $8.4 billion acquisition of Smartsheet (SMAR) by Vista Equity for $56.50 per share in cash was a new position for all six funds. At first glance their attraction to this deal does not make sense considering the spread on the deal rarely exceeded 2% after it was announced. However this was a pre-deal situation where the rumor of the deal came out about two months before the acquisition was confirmed, providing a nice return even after the rumor surfaced. Expected closing by January 31, 2025.

The $20 billion acquisition of Frontier Communications (FYBR) by Verizon (VZ) for $38.50 per share in cash was a new position for three funds. One of these funds decided to hedge their position with put options. The spread on the deal is a little over 10% (about 8% annualized). Expected closing by the first quarter of 2026.

In a big surprise to me, Intel (INTC) was a new position for three funds. Two of them expressed the trade through call options and exposure was very small. There was speculation that Qualcomm (QCOM) had approached Intel but it was later reported that Qualcomm’s interest had cooled. We updated this potential deal in our deals-in-the-works tool as “failed”.

The $3.8 billion acquisition of Amedisys (AMED) by UnitedHealth Group (UNH) for $101 per share in cash was a new position for two funds. The spread on the deal recently jumped to over 10% after the DOJ filed a lawsuit to block the deal. Expected closing was Q1 2025 but the timeline is likely to move a lot based on how the lawsuit plays out.

The $17.05 billion acquisition of Liberty Broadband (LBRDK) by Charter Communications (CHTR) in an all stock deal was a new position for two funds. The spread on the deal is nearly 10% but just 3.78% annualized considering how long this deal is going to take to close. The deal was announced earlier this month but news about Liberty submitting a counterproposal to Charter surfaced in late September. Expected closing is mid-2027.

There were several other new positions but two funds or less started those positions or the deal had already closed by the time the 13-F filings were released.

Two funds purchased call options on U.S. Steel (X) and one of them also added put options. One fund started a position in Vizio (VZIO), joining four other funds that had started a position in Q1 2024.

After each of the prior articles in this series, I have mentioned two or three deals that I found interesting after reviewing new additions by these funds. Out of the nine deals I mentioned in those four articles, seven closed and two are still active. Unfortunately, this time around, none of these new additions struck a chord with me and I will likely hunt in other places for opportunities like the 10 companies I shortlisted from the Dallas Three Part Advisors conference.

If you enjoyed reading this Report, please do me the huge favor of pressing the “Like” button or sharing it with other investors interested in special situations.

Disclaimer: I currently hold a long position in Capri (CPRI). Please do your own due diligence before buying or selling any securities mentioned in this article. We do not warrant the completeness or accuracy of the content or data provided in this article.

thanks for the write up. Very keen if US Steel closes. Wide spread.