A Flurry of Fascinating Insider Activity

This is an excerpt from our Insider Weekends article that we published on InsideArbitrage yesterday. Please feel free to reach out and let me know if you would like to continue seeing this kind of content or if we should stick to regular programming!

We are just a couple of weeks from the end of the third quarter of 2024, meaning insiders still have a days of freedom to make purchases and sales without violating the soon-to-come quiet period during earnings releases. This means that we have a host of insider purchases and sales to choose from and feature in our Insider Weekends articles. Instead of trying to pick just one company to feature in this week’s article, we decided to briefly touch upon three – Aptiv (APTV), Lionsgate Entertainment (LGF.A, LGF.B), and Berkshire Hathaway (BRK.A).

Aptiv PLC (APTV): $68.78

Market Cap: $18.28B

EV: $23.97B

Aptiv (APTV) is an Irish-American automotive technology supplier that offers advanced safety systems, electrification solutions, vehicle connectivity services, and more. The company also has operations in adjacent markets such as commercial vehicles, aerospace and defense, telecommunications, and industrial sectors.

We covered Aptiv in our most recent Buyback Wednesdays post earlier this week after the company announced a massive $5 billion buyback. The situation became all the more fascinating when Aptiv landed on top of our list of insider purchases this week. The Chairman and CEO, Kevin P. Clark purchased 29,770 shares for a total of $1.95 million.

We wrote the following about the share repurchase program in that article:

Last month, Aptiv PLC (APTV) announced a major $5 billion buyback, accounting for over one-fourth of its market cap at the time of announcement. The company also revealed plans to immediately launch a $3 billion ASR (Accelerated Share Repurchase) under existing and new authorizations. The combination of high short interest in the company (19 days to cover and 14% of float is short) and an accelerated share repurchase plan can create interesting price dynamics and we decided to take a closer look at the company.

The company currently has a market capitalization of $18.36 billion and an enterprise value of $24.05 billion. Aptiv’s EV/EBITDA for the trailing twelve months is the lowest it has been in the past four years. Given this undervaluation, management’s recent decision to announce an additional share buyback program appears well justified.

We like to see companies follow through on their big buyback announcements and actually reduce their shares outstanding. In Q1 2024, Aptiv repurchased $600 million worth of stock, and management increased the full-year repurchase target to $1.5 billion. This doubling of the buyback goal reflects the company’s belief in its undervaluation. Year-to-date, the company has repurchased 12.7 million shares for around $1.03 billion, all of which were retired.

On August 1, 2024, Aptiv’s Board of Directors approved a new $5 billion share repurchase program, representing over one-fourth of its market cap at announcement. This is in addition to the nearly $9 billion returned to shareholders since its IPO in 2011.

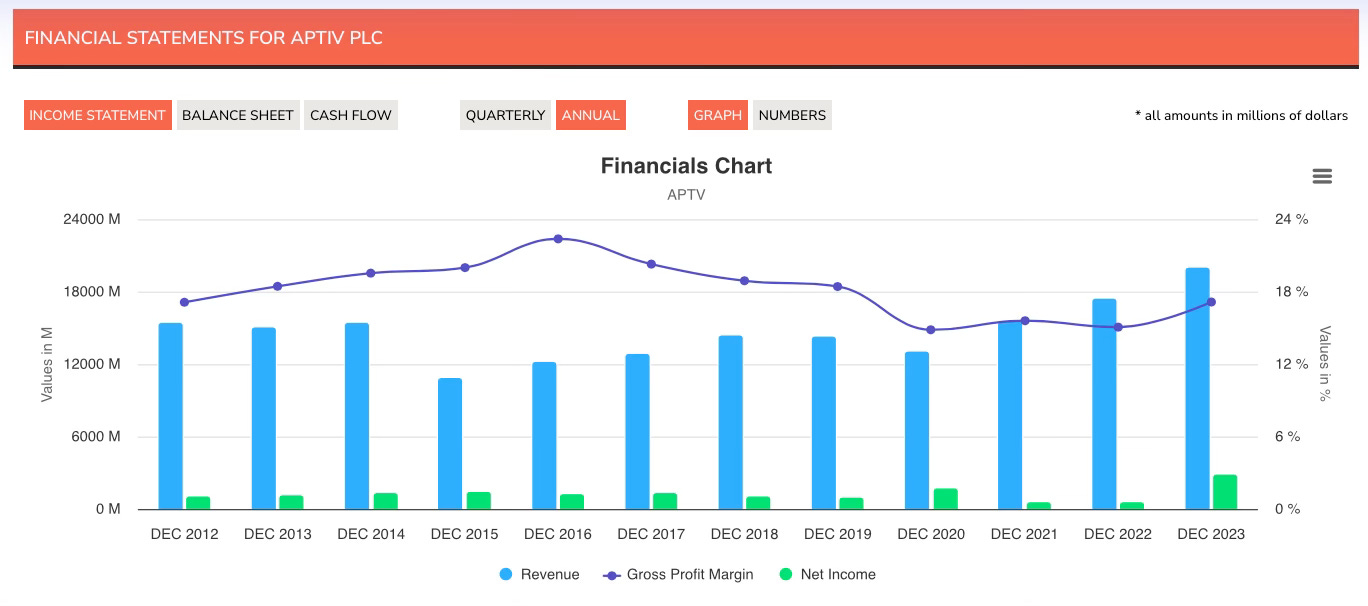

As we also covered in the article, Aptiv had fairly strong financial results with pretty consistent revenue growth, positive free cash flow of $1.35 billion, and easily manageable debt of $5.03 billion. Net income did fluctuate over the years as the company has a history of growth via acquisitions and joint ventures, the most recent of which was a joint venture with Hyundai, called Motional, to advance autonomous vehicle technologies.

The accelerated nature of the repurchase program that Aptiv announced was especially interesting considering the high short interest in the company. The special combination of insiders purchasing shares while the company is also buying stock on the open market is not common, and we track those companies in our custom Double Dipper Screener.

Lionsgate Entertainment (LGF.A): $7.82

Market Cap: $1.74B

EV: $6.22B

The second company we’ve decided to feature is Lionsgate Entertainment (LGF.A) – a familiar name to anyone who’s been reading our content for a while. We’ve featured Lionsgate in a number of Insider Weekends articles and monthly newsletters, covering each new twist and turn in the special situations bonanza the company presents.

This week, we continued to see insider purchases of Lionsgate by the former U.S. Secretary of the Treasury, Steve Mnuchin. Mr. Mnuchin purchased these shares via Liberty 77 Capital, his private equity firm, which is a 10% owner of Lionsgate. While we typically exclude purchases by 10% owners, given our history covering Lionsgate, we tend to pay attention to any insider purchases at the company – including Mr. Mnuchin’s.

When we last covered Lionsgate in our August 2024 newsletter, we discussed Mr. Mnuchin’s purchases and the Board of Director’s plan to eliminate the company’s dual-class structure. We were perplexed as to why Mr. Mnuchin was building a position of Lionsgate Class A voting shares, especially considering that the true value still seemed to lie in the spinoff, Lionsgate Studios (LION). We theorized Mr. Mnuchin was looking to build a position in order to influence the company as an activist investor at the parent company, Lionsgate Entertainment, to decide the future of the spinoff Lionsgate Studios. Lionsgate Entertainment still owns 87% of Lionsgate Studios. What’s especially interesting is that this week, Mr. Mnuchin has also started building a position of Class B non-voting shares.

The continued purchases by Mr. Mnuchin come at a time when Lionsgate Entertainment is being sued by the Canada Pension Plan Investment Boardin an effort to block the separation of the two business between the studio spinoff and the parent, cable and streaming service. A new possibility could be that Mr. Mnuchin is building a position to engineer a sale of Lionsgate Studios to a third party before the full spinoff happens – which results in profit for both Lionsgate Studios shareholders and the parent company Lionsgate Entertainment, thus placating the Canada Pension Plan Investment Board.

Berkshire Hathaway (BRK.A): $677,612

Market Cap: $964.80B

EV: $817.76B

The last company we’ll cover is the well-known Berkshire Hathaway (BRK.A). The Vice Chairman of Berkshire, Ajit Jain, sold 200 Class A shares for a total of $139 million – more than half of his stake in the company. Ajit Jain has been with Berkshire since 1986, specifically working on insurance operations and risk. He soon became so vital to the company that in Berkshire Hathaway’s 2008 annual shareholder letter, Warren Buffett mentioned that he wrote a letter to Ajit Jain’s parents in New Delhi jokingly asking them if they had another one like him at home. He stated the following in that letter, which you can read here:

Our third major insurance operation is Ajit Jain’s reinsurance division, headquartered in Stamford and staffed by only 31 employees. This may be one of the most remarkable businesses in the world, hard to characterize but easy to admire.

From year to year, Ajit’s business is never the same. It features very large transactions, incredible speed of execution and a willingness to quote on policies that leave others scratching their heads. When there is a huge and unusual risk to be insured, Ajit is almost certain to be called.

Ajit came to Berkshire in 1986. Very quickly, I realized that we had acquired an extraordinary talent. So I did the logical thing: I wrote his parents in New Delhi and asked if they had another one like him at home. Of course, I knew the answer before writing. There isn’t anyone like Ajit.

For many years, Ajit Jain was rumored to become Berkshire’s next CEO after Warren Buffet stepped down, but instead, Greg Abel (current Vice-Chairman of non-insurance operations) was selected as Buffet’s successor, with Howard Buffett slated to become Chairman. Mr. Jain currently serves as the Vice Chairman of insurance operations – and given that his job is entirely focused on estimating risk, it’s especially interesting that he chose to sell more than half his stake in the company.

The Form 4 reporting Mr. Jain’s sale was rather peculiar, especially considering that the sale was reported in Table 2 (covering derivative securities) instead of the typical Table 1 (covering non-derivative securities). Nevertheless, the sale itself represents something quite significant for Berkshire investors.

Mr. Jain’s massive sale of the company comes soon after Berkshire Hathaway’s market cap crossed $1 trillion (though it has since dipped back down to $965.91 billion) and news that Buffett has been rapidly selling down their positions in both Bank of America (BAC) and Apple (AAPL). These trends point to concerns with overall market valuation as well as the lack of opportunities for Berkshire to reinvest the money generated from those large sales.

Considering interest rates have been at elevated levels over the last two years, Buffett has managed to generate some returns by parking Berkshire’s massive cash position in U.S. government bonds. However, if the Fed starts cutting interest rates, that avenue of generating return dries up for Berkshire. Thus, the sale by Ajit Jain does pose a wake-up call to Berkshire Hathaway investors, though not due to the fact that the company or its collection of businesses are at risk. Instead, it alerts us that the opportunity cost of remaining invested in Berkshire at a time when reinvestment options for the massive conglomerate are dwindling may be much larger than expected.

Berkshire Hathaway was my top stock pick in 2021 as outlined in this article by Richard Howe and is a core holding in my personal portfolio.

Editor’s Note: Tamanna Suria contributed to this article.

If you enjoyed reading this article, please do me the huge favor of pressing the “Like” button or sharing it with other investors interested in special situations.

Disclaimer: I hold long positions in Lions Gate Entertainment (LGF.B), Lionsgate Studios (LION) and Berkshire Hathaway (BRK.B). Please do your own due diligence before buying or selling any securities mentioned in this article. We do not warrant the completeness or accuracy of the content or data provided in this article.

Sorry for APTV, do you mean FCF of 1.9B?

Where did you come up with $19.5 billion in fcf for Aptiv? I see $1.351 billion.