A CVR Database, Ranking of Insiders and a Whole Lot More

Over the last year, I have had the good luck of being invited to give guest lectures for students at Columbia University, the University of Wisconsin and the University of Alabama. I was delighted when I was asked to return and lecture a new batch of students at the University of Wisconsin later this month. The topic of my lecture at each of these universities has been the use of Contingent Value Rights or CVRs in M&A.

We have discussed CVRs numerous times on InsideArbitrage, going back as much as nine years ago, when I wrote the article Tobira Therapeutics Hits The Jackpot and Provides a Nice Kicker and more recently in an article titled Roche to Buy Poseida, With a Potential $4 Lottery Ticket.

A paragraph from the Tobira article best describes what CVRs are and why I find them fascinating:

“I have invested in situations that included a CVR as a kicker, where investors get one or more additional payments in the future if certain milestones are met after the closing of the deal. These kinds of CVRs are often seen in pharma/biotech types of deals where the company being acquired has drugs in their pipeline that could get approved long after the deal has closed. I have also seen CVRs attached to the disposal of real estate in deals such as the acquisition of Safeway by Cerberus Capital Management. I have participated in some of these deals that include CVRs because the merger spreads in those deals were sufficient to make the CVR almost free.”

One of the big challenges of CVRs is figuring out how many of them actually pay out. A second challenge is the long timeline associated with payouts even if the milestones are achieved. A third challenge is that most of these CVRs are not tradable and are hard to track in client portfolios or you need to transfer your account from one broker to another. They could however work well in a fund structure or in personal portfolio and they were a favorite of Joel Greenblatt, as discussed in his book You Can Be a Stock Market Genius.

While we can’t do much to tackle the second and third challenges, we decided to address the first one by building a CVR Deals tool that includes every deal over the last 15 years with a CVR attached to it and the outcomes of each milestone.

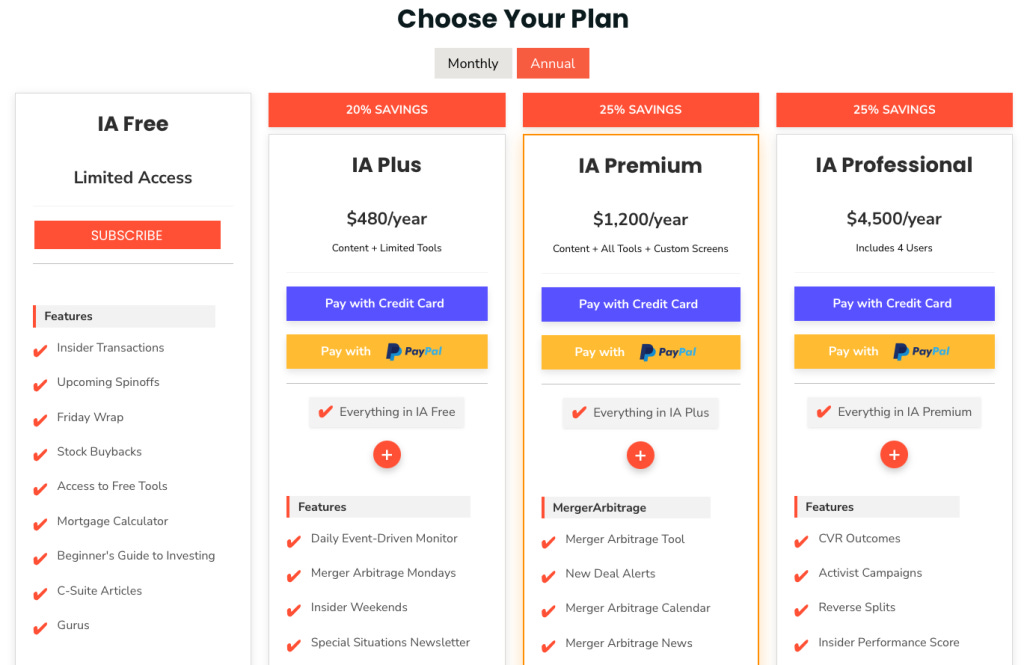

We are rolling out the CVR Deals tool along with several additional features including a Shareholder Activists Tool, a Reverse Splits Tracker and an Insider Performance Score (IPS) for our IA Professional subscription tier today.

I am often asked by subscribers who were signing up for InsideArbitrage, about the difference between the IA Premium and IA Professional service. Until now both services were exactly the same but the IA Professional tier provided four licenses at a discounted price. With the rollout of these four features, we are now starting to build out our IA Professional tier with a unique set of tools that will hopefully prove to be indispensable for professional investors.

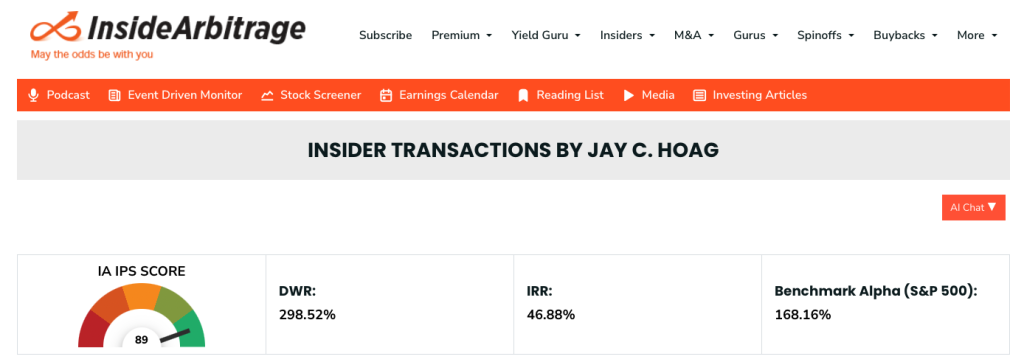

The Insider Performance Score (IPS) is a personal favorite of mine as it scores the tens of thousands of insiders in our database to quickly show how a specific company insider has performed in the past following their insider purchases. Past performance does not guarantee positive future results but with insiders it helps me improve the signal from the noise. If I find that a company scores well in our IA Score quant model and the insider buying the stock score well on the IPS, I am inclined to take a closer look.

One of the best-performing insiders we have tracked for more than a decade is Jay Hoag, who serves on the boards of both Netflix and Zillow. He was the subject of a case study in my book The Event-Driven Edge in Investing and you can see how he scores on the IPS below.

We are also actively working on new tools for the IA Professional tier that we plan to release in the next few weeks, including a management change tracker that will provide early signals about positive changes a new CEO is effecting at a company, much like we saw with Larry Culp at GE or David Risher at Lyft.

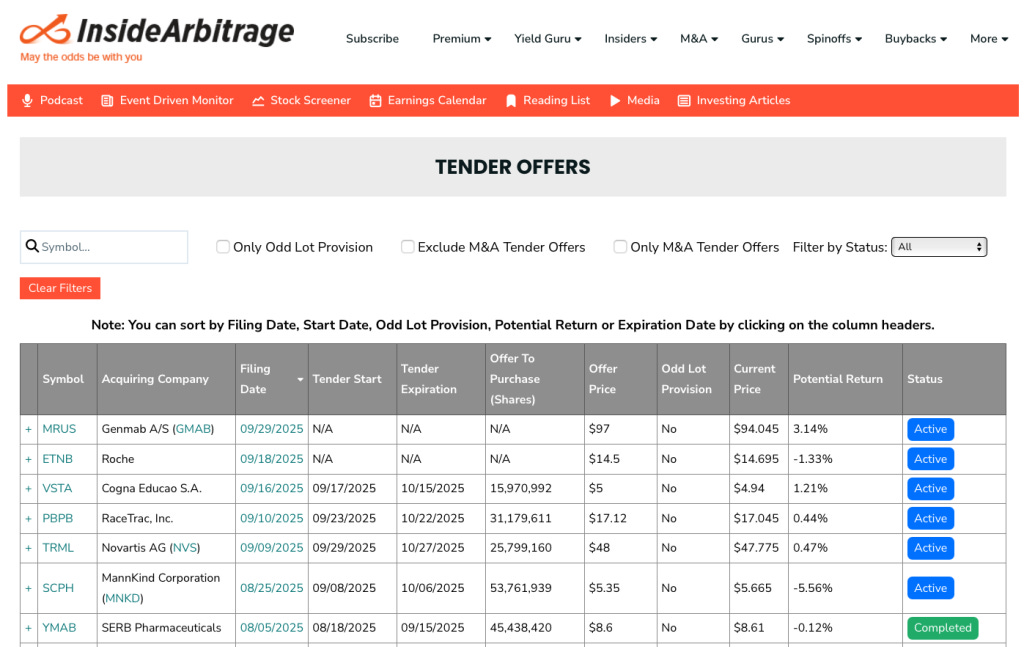

We have not stopped building for the IA Premium tier and a few weeks ago released a new feature that allows you to track Tender Offers, including the ability to filter for tender offers with an odd-lot provision or just M&A related tender offers.

We hope that you find these new features valuable and as always I am available to answer any questions you might have about the service or how to use the wide range of features and custom screens we have built into the InsideArbitrage platform.

Disclaimer: Please do your own due diligence before buying or selling any securities mentioned in this article. We do not warrant the completeness or accuracy of the content or data provided in this article.